DOWNLOAD

Submit the form below to continue your download

SUCCESS

Your download will begin shortly, if it does not start automatically, click the button below to download now.

DownloadBIO

Asher Goldman is a Vice President on Generate’s investment team, where he focuses on originating, diligencing, and executing investments in infrastructure projects and companies deploying climate solutions.

Since joining Generate in 2018, Asher has worked on waste-to-value projects, especially in the food- and agricultural-waste sectors and in the low-carbon fuels market. Outside of Generate, Asher has worked in venture capital and market advisory roles in the climate tech and energy space. Asher attended Northwestern University where he earned a BS in Environmental Engineering and an MS in Mechanical Engineering in Energy & Sustainability, and holds an MBA from Wharton.

An inflection point for the LCFS

California’s Low Carbon Fuel Standard (LCFS) program catapulted the state’s decarbonization progress, but policy updates are needed for the program to remain a critical market creator for decarbonization technologies.

Expert View By Asher Goldman

BIO

Asher Goldman is a Vice President on Generate’s investment team, where he focuses on originating, diligencing, and executing investments in infrastructure projects and companies deploying climate solutions.

Since joining Generate in 2018, Asher has worked on waste-to-value projects, especially in the food- and agricultural-waste sectors and in the low-carbon fuels market. Outside of Generate, Asher has worked in venture capital and market advisory roles in the climate tech and energy space. Asher attended Northwestern University where he earned a BS in Environmental Engineering and an MS in Mechanical Engineering in Energy & Sustainability, and holds an MBA from Wharton.

Imagine, for a moment, that we’ve invented a new device. Maybe it’s a bit like a catalytic converter: you put it in your car’s tailpipe and, boom, it reduces the volume of carbon emissions from your vehicle. Amazingly, the device gets better with age, wringing out more and more emissions each year. And crucially, the device is cheap, proven, and ready to be adopted at scale. Although the device doesn’t exist, California’s Low Carbon Fuel Standard (LCFS) is a policy that delivers these outcomes.

The LCFS program is simple at its core: low-carbon fuels receive tradeable credits and high-carbon fuels receive deficits. Deficits are offset by credits and companies are not allowed to end the year with deficits. The volume of credits or deficits a fuel creates is a product of its carbon intensity – the carbon emissions produced over the lifecycle of producing, transporting, and using that fuel. The program grows stricter over time to ensure the continued ramp up of decarbonization efforts: each year, high-carbon fuels produce more deficits and low-carbon fuels produce fewer credits.

The intended flexibility and stability of the program structure was designed to encourage investors, project developers, and fleet operators to make long-term investments in their desired decarbonization technology – from EV chargers to biofuels – without fearing policy changes each year.

Another important attribute of the policy structure is that the cost of the program is not shouldered by taxpayers, but the producers of high carbon fuels. The LCFS program has helped Generate deploy sustainable technologies, primarily renewable natural gas, necessary for the infrastructure transition.

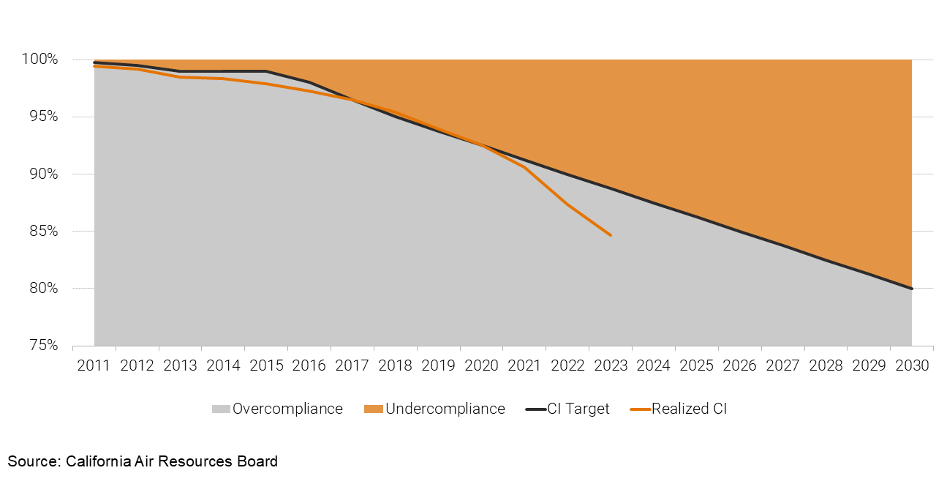

Since the program’s inception in 2011, California has decarbonized its transportation sector at a quicker pace, lower cost, and to a greater extent than any other US state. It also exceeded the state’s own projections: by the end of 2023, the carbon intensity of California’s transportation sector had decreased 15.3% since 2010 – already surpassing California’s goal for 2026.

While the LCFS program has had a huge impact, its design is not perfect. From 2018 through 2021, the program incentivized billions of dollars of private investment into low-carbon fuel production. Unfortunately, that success challenged the program’s design by causing an oversupply of credits in the market and tanking the price of credits. When credits are cheap, it’s harder to build and borrow against them. At present, very few companies are building new projects to serve the California market as the economic incentive has fallen away. The regulatory body that oversees the LCFS policy – the California Air Resources Board (CARB) – has been amending the policy over the last four years in part to fix this problem.

There are three tweaks to the policy that will help achieve this goal and maintain the LCFS regime as a critical market creator for decarbonization technologies:

- First, we need to fix the near-term credit over-supply by changing the 2025 decarbonization target from its currently mandated rate of 13.25% below the 2010 baseline to between 22.25% and 24.25%. In a promising sign, on August 12 CARB published a proposal to change the 2025 target to 22.25%.

- Second, we need to set the long-term decarbonization targets to levels that are both ambitious and achievable. We think a good benchmark would be a 35% decarbonization target by 2030 and 90% by 2045.

- Last but certainly not least, CARB should work to ensure that the recent supply and demand imbalances do not repeat and persist in the future. On the table for discussion is a new provision called the Auto Acceleration Mechanism. This would automatically adjust the future decarbonization targets of the LCFS if certain conditions were met, such as the supply of credits materially outpacing the demand for them.

The program is also not without its critics. A recent Politico article was headlined, “Everybody hates the LCFS.” It inspires ire from both large emitters and many progressive groups. It’s often said a good compromise is when both parties are dissatisfied and that is certainly true of the LCFS. California has created a markedly impactful program that has done what few if any climate policies have ever accomplished: being ahead of schedule. It has inspired, at time of writing, four LCFS programs in other states with another seven under consideration. California should now make the necessary updates to its program that would allow it to spearhead the next phase of decarbonization.

More insights

Industrial Decarbonization: How Thermal Storage Can Electrify Heat at Scale

Investment in thermal energy storage has accelerated in recent years as technical progress and customer demand have improved project bankability. Since 2020, sector funding has grown and shifted toward later-stage investors, reflecting greater confidence in TES’s readiness for commercial deployment.

Read moreConsolidation: The Pathway to Enduring Impact

It is easy to be disoriented by the swing from exuberance to pessimism that has defined the clean energy sector in recent years. Yet these moments are precisely when opportunity is greatest. Beneath the headlines are clear indicators of tremendous potential in the U.S. energy transition. The challenge is to separate fundamentals from sentiment, to acknowledge and fix the mistakes that we have made, and to chart a path to scale rooted in discipline, operational excellence, and commercial reality.

Read moreMeeting load growth with clean, flexible power

In the wake of the One Big Beautiful Bill, load growth remains a clear and steady tailwind for renewable energy. Renewables remain the cheapest source of power and the quickest to install, ensuring a bright outlook for the industry despite the shortened available window for some tax incentives. Over the last twenty years, annual investment in renewable energy in the U.S. increased from $5 billion to $100 billion (BloombergNEF, 1H 2025 Renewable Energy Investment Tracker). Compelling economics and flexible demand has the potential to unlock even greater investment in the sector: powering new load with electricity that would otherwise be wasted boosts project economics, ensures quick access to power, and delivers system-wide benefits.

Read more