DOWNLOAD

Submit the form below to continue your download

SUCCESS

Your download will begin shortly, if it does not start automatically, click the button below to download now.

DownloadBIO

Logan Goldie-Scot is a VP of Research and Impact at Generate Capital, responsible for building and communicating the firm’s information advantage. He is focused on developing proprietary insights relating to Generate’s six core sectors, while supporting market-wide coverage and origination efforts.

Prior to Generate, Logan joined BloombergNEF in 2010 and was Head of Clean Power research when he left in 2022. This was a 30-person group spanning solar, wind, energy storage and power grids. At BloombergNEF he previously worked as a solar analyst, built and led the Energy Storage team, and developed the firm’s first clean energy Index and ETF, in collaboration with Goldman Sachs. Logan is a regular writer, speaker and conference panellist on topics relating to the energy transition. He has an MA (Hons) in Arabic from Edinburgh University and in 2019 completed executive training in Supply Chain Management at Stanford GSB.

The middle-market 0pportunity

Global energy transition and climate investment rose to $2 trillion in 2023 according to BloombergNEF, roughly five times what it was a decade ago when Generate was founded.

Expert View By Logan Goldie-Scot

BIO

Logan Goldie-Scot is a VP of Research and Impact at Generate Capital, responsible for building and communicating the firm’s information advantage. He is focused on developing proprietary insights relating to Generate’s six core sectors, while supporting market-wide coverage and origination efforts.

Prior to Generate, Logan joined BloombergNEF in 2010 and was Head of Clean Power research when he left in 2022. This was a 30-person group spanning solar, wind, energy storage and power grids. At BloombergNEF he previously worked as a solar analyst, built and led the Energy Storage team, and developed the firm’s first clean energy Index and ETF, in collaboration with Goldman Sachs. Logan is a regular writer, speaker and conference panellist on topics relating to the energy transition. He has an MA (Hons) in Arabic from Edinburgh University and in 2019 completed executive training in Supply Chain Management at Stanford GSB.

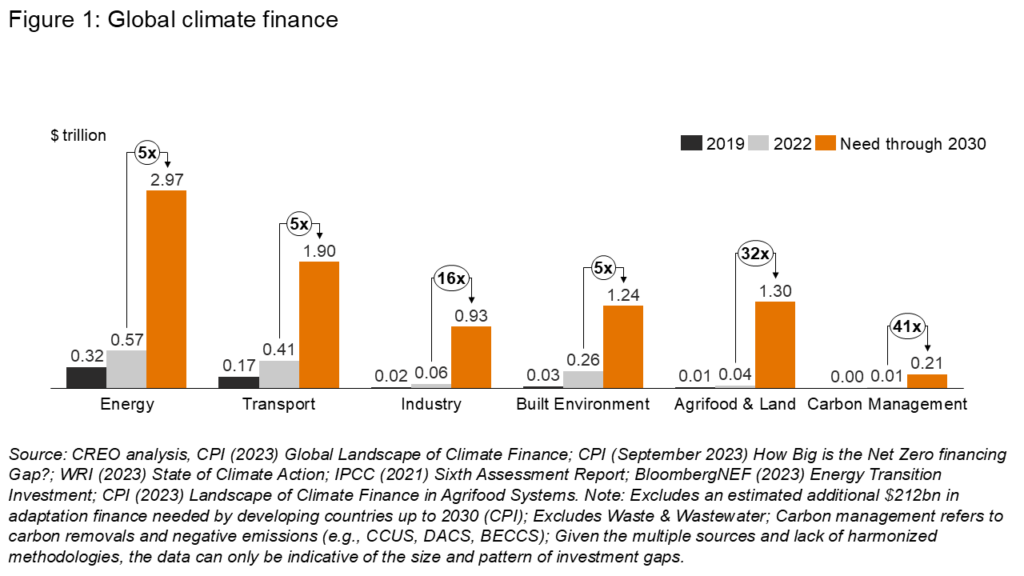

Looking ahead, to meet global climate targets, annual spending across energy, transport, and the built environment needs to increase fivefold through to 2030 (Figure 1). The required scale-up is even greater in areas like industrial processes where investment has yet to really get off the ground.

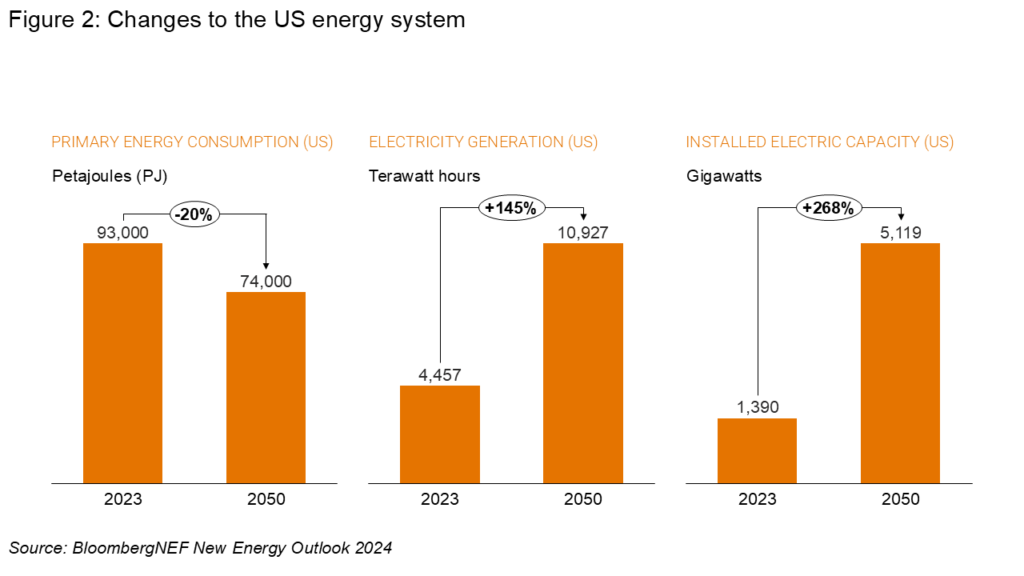

The trillions of dollars of investment both decarbonize and transform the system we know today. This results in a very different deal profile compared to earlier waves of infrastructure investment. For starters, the power system becomes central to our decarbonization efforts: widespread electrification results in a more efficient energy system and a much larger power system. In the US for instance, primary energy drops 20% by 2050 but required electric capacity increases 268% (Figure 2).

While gigawatt-scale nuclear facilities and interstate, as well as interregional, transmission capacity remain critical, the US power system is increasingly distributed. A scan of the 30,000 operating power projects across the country is illustrative here: the average size of a US coal facility is 404 MW, a natural gas project is 86 MW, and a solar project is just 17 MW (Orennia). Eighty percent of new capacity that came online last year was solar, wind, and storage, further entrenching this dynamic.

In terms of the capital environment, climate funds raised a total of $110 billion in 2023 (Pitchbook), 4.5 times what was raised a decade ago. While this marks progress, it falls far short of the scale of investment needed. Annual capital requirements across the six sectors shown in Figure 1 total $9 trillion through 2030, a stark contrast to recent records still counted in billions. We still have a long way to go.

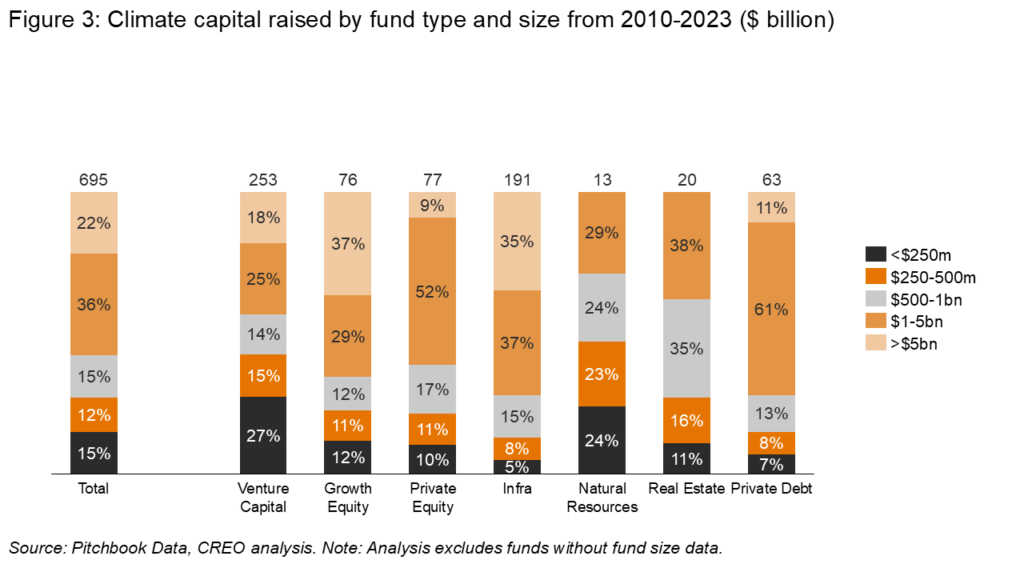

Much of the new capital flowing into the market is going into large, billion-dollar-plus funds. Only 13% of funds raised from 2010 to 2023 in infrastructure were below $500 million, with an additional 15% being sub $1 billion. We need all kinds of investment into all sizes of assets, but we must also understand that the nature of the system we’re building is different. Alongside large funds focused on big projects, we need to invest real capital into the middle market.

Some 80% of US energy transition deals by count (Infralogic) and 40% by amount had a deal value below $400 million. Deals larger than this typically have high transaction costs, are focused on monolithic assets, and benefit from asset-size economies of scale. In the new paradigm, the minimum efficient scale to deliver compelling customer value shifts downwards. As large infrastructure funds have shifted their focus to mega-deals, these smaller deals risk being overlooked.

This creates a significant opportunity for specialized managers who understand and can create value from smaller, distributed assets. Alongside the healthy deal flow, this asset class is also remarkably attractive. Technology costs have fallen dramatically, driven by manufacturing rather than asset economies of scale. Smaller assets are also less likely to face cost overruns, a challenge often seen in mega-projects (Professor Bent Flyvbjerg, How Big Things Get Done). The cost of coordinating these distributed assets has also fallen considerably while the value they deliver both to customers and to the broader system is on the rise.

Investors who understand this opportunity are already taking advantage of these dynamics. Success requires a deep understanding of these types of assets and how the size, technology profiles, and customer dynamics are different from their large-scale predecessors. Done well, the rewards can be meaningful: middle-market funds relative to large-cap funds have delivered between 150 and 250 basis points of better return on a risk-adjusted basis (Patrizia, Investing in mid-market infrastructure).

More insights

Industrial Decarbonization: How Thermal Storage Can Electrify Heat at Scale

Investment in thermal energy storage has accelerated in recent years as technical progress and customer demand have improved project bankability. Since 2020, sector funding has grown and shifted toward later-stage investors, reflecting greater confidence in TES’s readiness for commercial deployment.

Read moreConsolidation: The Pathway to Enduring Impact

It is easy to be disoriented by the swing from exuberance to pessimism that has defined the clean energy sector in recent years. Yet these moments are precisely when opportunity is greatest. Beneath the headlines are clear indicators of tremendous potential in the U.S. energy transition. The challenge is to separate fundamentals from sentiment, to acknowledge and fix the mistakes that we have made, and to chart a path to scale rooted in discipline, operational excellence, and commercial reality.

Read moreMeeting load growth with clean, flexible power

In the wake of the One Big Beautiful Bill, load growth remains a clear and steady tailwind for renewable energy. Renewables remain the cheapest source of power and the quickest to install, ensuring a bright outlook for the industry despite the shortened available window for some tax incentives. Over the last twenty years, annual investment in renewable energy in the U.S. increased from $5 billion to $100 billion (BloombergNEF, 1H 2025 Renewable Energy Investment Tracker). Compelling economics and flexible demand has the potential to unlock even greater investment in the sector: powering new load with electricity that would otherwise be wasted boosts project economics, ensures quick access to power, and delivers system-wide benefits.

Read more