DOWNLOAD

Submit the form below to continue your download

SUCCESS

Your download will begin shortly, if it does not start automatically, click the button below to download now.

DownloadBIO

Ed Bossange is the Chief Capital Formation Officer at Generate Capital. Ed brings more than 10 years of experience in renewable energy and project finance.

Prior to Generate, he was a vice president of origination and structuring at Morgan Stanley, where he sat in the North America Power and Gas business on the commodities trading floor, investing the firm’s balance sheet into renewable energy assets. He spent more than six years at Morgan Stanley, primarily focused on originating, acquiring, developing, and financing solar PV projects across residential, commercial, industrial, and small utility scale, which included playing an integral role in more than $200 million of the first community solar portfolios institutionally financed in the United States. Ed began his career in renewable energy as a design engineer for both solar PV and solar hot-water-system integration in New York City. Ed holds an MS in Mechanical Engineering‐Energy Systems from Columbia University and a BS in Mathematics from Hamilton College.

Investors and banks are voting for the infrastructure transition with their dollars

The US election’s outcome will undoubtedly have consequences for the infrastructure transition, but rumors of its death are overblown. While the market may face challenges, these challenges will prompt a flight to quality investors and assets.

Expert View By Edward Bossange and Jonah Goldman

BIO

Ed Bossange is the Chief Capital Formation Officer at Generate Capital. Ed brings more than 10 years of experience in renewable energy and project finance.

Prior to Generate, he was a vice president of origination and structuring at Morgan Stanley, where he sat in the North America Power and Gas business on the commodities trading floor, investing the firm’s balance sheet into renewable energy assets. He spent more than six years at Morgan Stanley, primarily focused on originating, acquiring, developing, and financing solar PV projects across residential, commercial, industrial, and small utility scale, which included playing an integral role in more than $200 million of the first community solar portfolios institutionally financed in the United States. Ed began his career in renewable energy as a design engineer for both solar PV and solar hot-water-system integration in New York City. Ed holds an MS in Mechanical Engineering‐Energy Systems from Columbia University and a BS in Mathematics from Hamilton College.

BIO

Jonah is the Chief Strategy Officer at Generate where he oversees our communications, government engagement, and impact assessment and strategy.

Prior to Generate, Jonah led Breakthrough Energy a network founded by Bill Gates including investment funds, nonprofit and philanthropic programs, and policy efforts linked by a common commitment to scale the technologies we need to achieve a path to net zero emissions by 2050. During that time, he also served as Mr. Gates’s senior advisor for policy and government relations. Prior to Breakthrough Energy, Jonah spent nearly 15 years in Washington, D.C., leading integrated advocacy, communications, and grassroots campaigns. He led a series of policy efforts on a variety of issues – from civil rights to education reform to nuclear non-proliferation. Before that, he served as primary spokesperson and chief strategist for the largest national campaign to protect voting rights. Jonah holds a J.D. degree from Boston College Law School and a B.A. degree in History from Binghamton University. Jonah lives in Seattle with his wife Jackie and his two children, Desmond and Fiona.

Infrastructure investors with strong track records, specialized expertise, attractive returns, large pipelines, and operational and investment experience will continue to garner the backing of large investors and banks. Steel will still go in the ground to build the sustainable infrastructure assets that have created real economic value in communities across the country.

The Policy Outlook

Evaluating how a second Trump administration will shape the infrastructure transition requires understanding how federal policy interacts with economic markets. We are now in a phase of the infrastructure transition where what was once theoretical is now real. Money promised by the Inflation Reduction Act (IRA) is flowing, and that money is showing up in states and districts across the country. Those projects were built by real people, in real communities, and they are powering real homes, schools, hospitals, and grocery stores. In short, it’s now a fixture of the real economy.

The infrastructure transition’s tangibility makes it more resilient to policy shifts. Policy often has a symbiotic, mutually reinforcing relationship with flows of capital. Productive policy leads investors to put steel in the ground, jobs on the board, and helps communities of voters thrive – which begets more policy and more capital from the public and private sectors, to expand those successes. Fundamentally, this relationship keeps economic shifts durable across political fluctuations. This is where the rhetoric of politics diverges from the reality of policy – in August, eighteen Republican House members wrote a letter defending the IRA and vowing to vote against it. Fourteen won reelection.

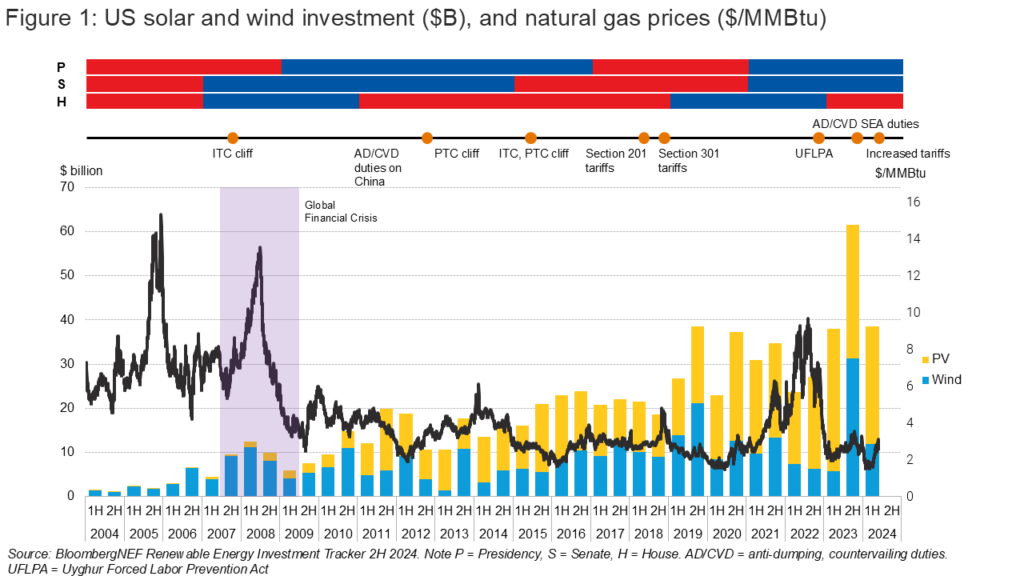

The new administration will change the contours of the transition in the short term – what gets invested in, where those investments are made, and with what public support – but it won’t stop the transition. As shown in Figure 1, the transition has already weathered several cycles of red and blue waves, as well as major economic events and policy regimes including the global financial crisis, fluctuations in gas prices, and varying approaches toward tariffs. When mapped against investment in the US wind and solar industries, the resulting chart illustrates how the clean energy industry has grown steadily despite changing political realities.

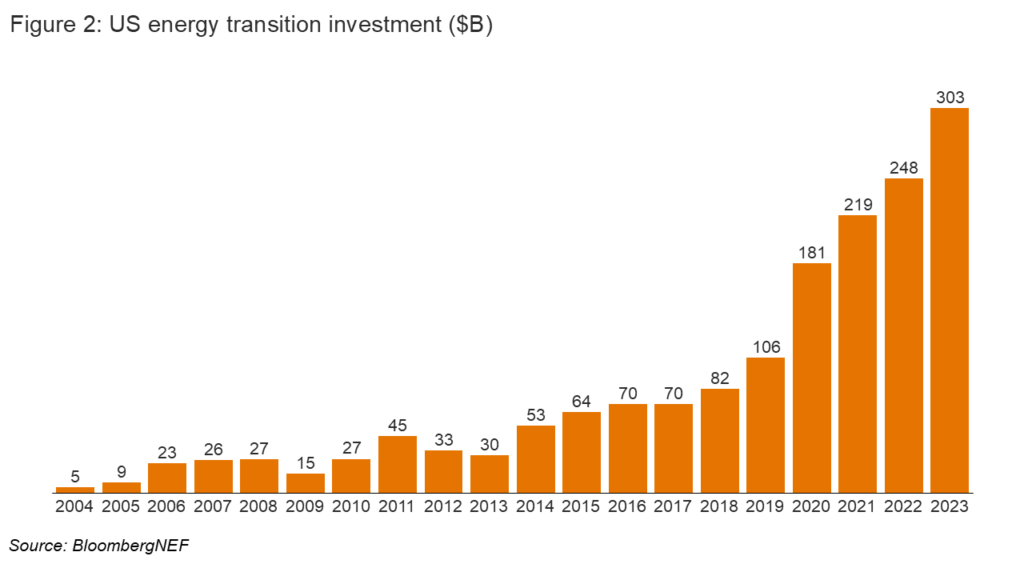

The situation was the same over the last 12 months. A Harris victory was never a foregone – or bankable – conclusion, and the prospect of Democratic control over the Senate, House, and Presidency was unlikely. Yet that hasn’t stopped investment from flowing into the sustainable infrastructure market, especially as energy transition assets become more mainstream. Last year garnered the highest-ever investment in the US energy transition, with $303 billion invested compared to $30 billion 10 years prior (BloombergNEF).

The Funding Environment

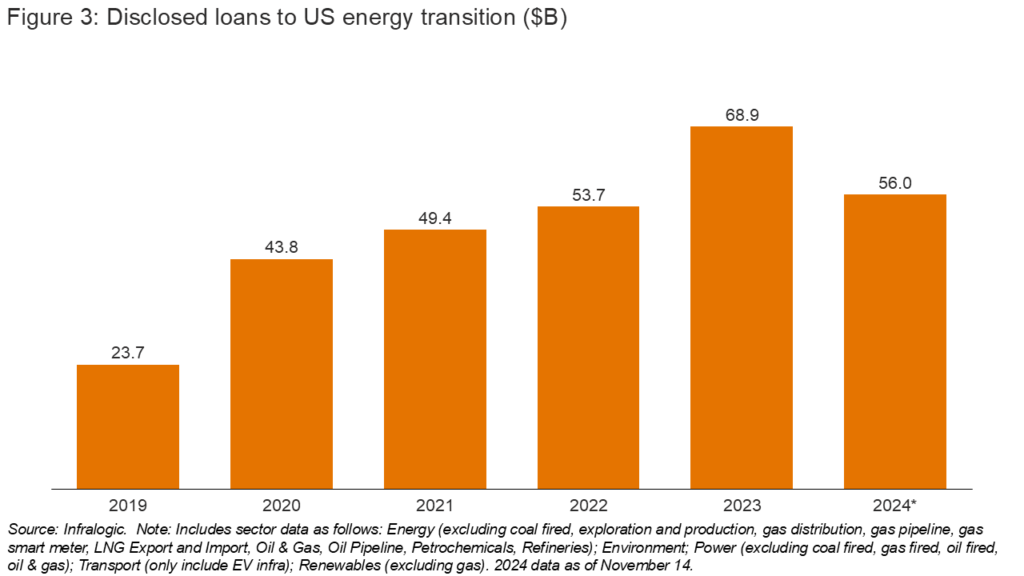

These investment figures underscore how the sustainable infrastructure market has grown into an established market able to withstand headwinds and secure capital from prominent and respected capital providers. Back in 2014 when Generate was founded, the infrastructure transition was seen as a risky, emerging market, with skepticism around the viability of its theory of the case. In the succeeding 10 years, anchors of the financial industry have backed it with their dollars. Commercial banks have loaned $125 billion to US energy transition projects and companies since the beginning of 2023, and 2024 totals as of mid-November already exceed 2022 levels.

We do not expect the funding environment for sustainable infrastructure projects to be imperiled now that the market is experiencing more headwinds. Rather, we anticipate a flight to quality. In environments where capital is more constricted and investors and lenders therefore have a lower appetite for risk, performance records are critical. There are, and will continue to be, capital and investment opportunities available to serious sustainable infrastructure investors and operators capable of delivering commercially. These firms have the expertise and pipelines needed to adapt and take advantage of existing opportunities, withstand scrutiny, and inspire investor and lender confidence. Key among the proof points for these firms are the ability to raise capital from the most respected and rigorous investors and secure loans from the best banks.

Generate is proud to be considered one of these trusted firms. Earlier this year, Generate announced our $1.5 billion fundraise from investors including CalSTRS, Hesta, QIC, and others (link). Most recently, we secured a $1.2 billion corporate credit facility from JP Morgan, BMO, Scotiabank, and 11 other lenders (link). These financings substantiate Generate’s reputation as a long-term player in the infrastructure transition, built to withstand economic and political cycles. We continue to raise and secure capital by remaining targeted and focused on building assets, providing real value to communities and customers, and using our market knowledge to take risks and structure deals creatively, such as through our tax equity (link) and credit strategies (link). And so the cycle continues. Policy will drive investments, and good investments will support good policy. The firms that can navigate both will be successful in both the fat times and the lean times.

Amid the confusion stemming from our current political landscape, large investors and banks continue to vote with their dollars – and the numbers show they have voted in favor of the infrastructure transition. These funders have demonstrated their confidence in firms like Generate to continue building sustainable infrastructure projects and markets, and we are committed to proving their case.

Contributors

Edward Bossange

Chief Capital Formation Officer

Jonah Goldman

Chief Strategy Officer

SECTIONS

More insights

Industrial Decarbonization: How Thermal Storage Can Electrify Heat at Scale

Investment in thermal energy storage has accelerated in recent years as technical progress and customer demand have improved project bankability. Since 2020, sector funding has grown and shifted toward later-stage investors, reflecting greater confidence in TES’s readiness for commercial deployment.

Read moreConsolidation: The Pathway to Enduring Impact

It is easy to be disoriented by the swing from exuberance to pessimism that has defined the clean energy sector in recent years. Yet these moments are precisely when opportunity is greatest. Beneath the headlines are clear indicators of tremendous potential in the U.S. energy transition. The challenge is to separate fundamentals from sentiment, to acknowledge and fix the mistakes that we have made, and to chart a path to scale rooted in discipline, operational excellence, and commercial reality.

Read moreMeeting load growth with clean, flexible power

In the wake of the One Big Beautiful Bill, load growth remains a clear and steady tailwind for renewable energy. Renewables remain the cheapest source of power and the quickest to install, ensuring a bright outlook for the industry despite the shortened available window for some tax incentives. Over the last twenty years, annual investment in renewable energy in the U.S. increased from $5 billion to $100 billion (BloombergNEF, 1H 2025 Renewable Energy Investment Tracker). Compelling economics and flexible demand has the potential to unlock even greater investment in the sector: powering new load with electricity that would otherwise be wasted boosts project economics, ensures quick access to power, and delivers system-wide benefits.

Read more