DOWNLOAD

Submit the form below to continue your download

SUCCESS

Your download will begin shortly, if it does not start automatically, click the button below to download now.

DownloadBIO

Scott Gosselink was Generate Capital’s first employee and serves as a Managing Director, Head of Underwriting, and is a member of Generate’s Investment Committee.

With more than 15 years of experience in the energy industry, Scott focuses on the emerging clean mobility sector by accelerating the decarbonization of transportation. Prior to Generate Capital, Scott spent time at SunEdison, EDF-Renewable Energy, and the Lower Colorado River Authority where he developed, marketed, and structured several billion dollars for renewable energy and energy transition projects. Scott received his Bachelor of Science in Commerce from Washington and Lee University, and an MBA from the Yale School of Management.

Meeting load growth with clean, flexible power

Expert View By Scott Gosselink, Logan Goldie-Scot and Ryan Miller

BIO

Scott Gosselink was Generate Capital’s first employee and serves as a Managing Director, Head of Underwriting, and is a member of Generate’s Investment Committee.

With more than 15 years of experience in the energy industry, Scott focuses on the emerging clean mobility sector by accelerating the decarbonization of transportation. Prior to Generate Capital, Scott spent time at SunEdison, EDF-Renewable Energy, and the Lower Colorado River Authority where he developed, marketed, and structured several billion dollars for renewable energy and energy transition projects. Scott received his Bachelor of Science in Commerce from Washington and Lee University, and an MBA from the Yale School of Management.

BIO

Logan Goldie-Scot is a VP of Research and Impact at Generate Capital, responsible for building and communicating the firm’s information advantage. He is focused on developing proprietary insights relating to Generate’s six core sectors, while supporting market-wide coverage and origination efforts.

Prior to Generate, Logan joined BloombergNEF in 2010 and was Head of Clean Power research when he left in 2022. This was a 30-person group spanning solar, wind, energy storage and power grids. At BloombergNEF he previously worked as a solar analyst, built and led the Energy Storage team, and developed the firm’s first clean energy Index and ETF, in collaboration with Goldman Sachs. Logan is a regular writer, speaker and conference panellist on topics relating to the energy transition. He has an MA (Hons) in Arabic from Edinburgh University and in 2019 completed executive training in Supply Chain Management at Stanford GSB.

BIO

Ryan Miller is a Principal at Generate Capital, overseeing investments in power, digital infrastructure, and transportation.

With over 10 years of experience in renewable energy and infrastructure investing, Ryan has been involved in over $5 billion in sustainable infrastructure transactions. Prior to joining Generate in 2021, Ryan was a Strategic Business Development Advisor at Shell New Energies, focusing on onshore renewable power project acquisitions and development partnerships. Prior to Shell, Ryan worked on JP Morgan’s tax equity team where he structured and executed complex tax equity transactions. Earlier in his career, he held various positions in banking and capital markets. Ryan holds a B.S. in Finance from Virginia Tech and is a CFA charterholder. He is based in Generate Capital’s New York City office and is an active member of the LGBTQIA employee resource group.

In the wake of the One Big Beautiful Bill, load growth remains a clear and steady tailwind for renewable energy. Renewables remain the cheapest source of power and the quickest to install, ensuring a bright outlook for the industry despite the shortened available window for some tax incentives. Over the last twenty years, annual investment in renewable energy in the U.S. increased from $5 billion to $100 billion (BloombergNEF, 1H 2025 Renewable Energy Investment Tracker). Compelling economics and flexible demand has the potential to unlock even greater investment in the sector: powering new load with electricity that would otherwise be wasted boosts project economics, ensures quick access to power, and delivers system-wide benefits.

Powering economic growth

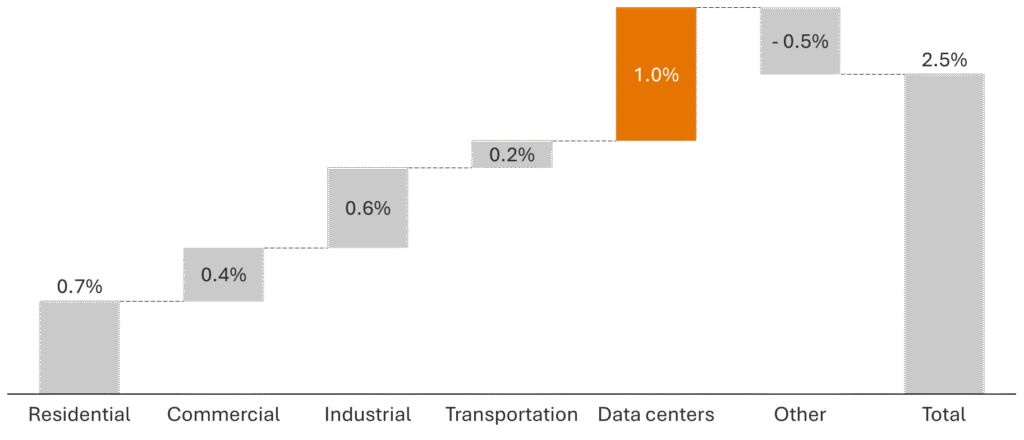

Powering U.S. economic growth over the coming decade requires adding on average ≈120 terawatt-hours per year (Orennia), significantly more than at any point in recent history. Goldman Sachs estimates that data centers will make up 40% of this U.S. growth through to 2030, when they would account for ≈8% of total U.S. electricity demand (Figure 1).

Figure 1: US power demand CAGR through to 2030

Affordable power

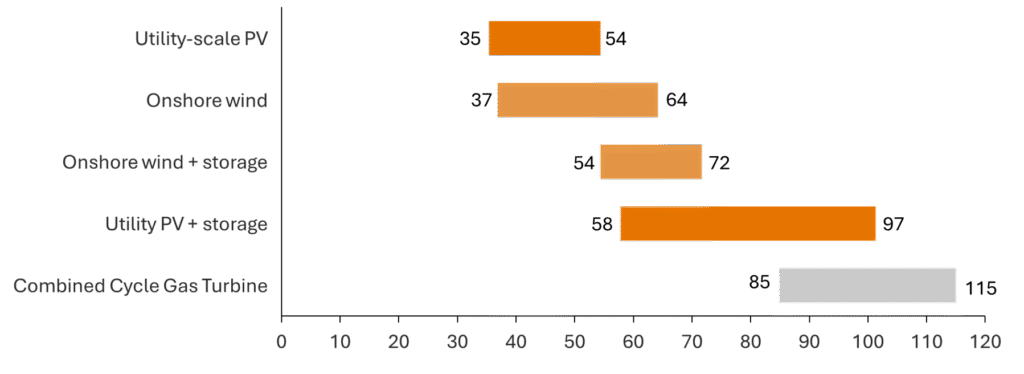

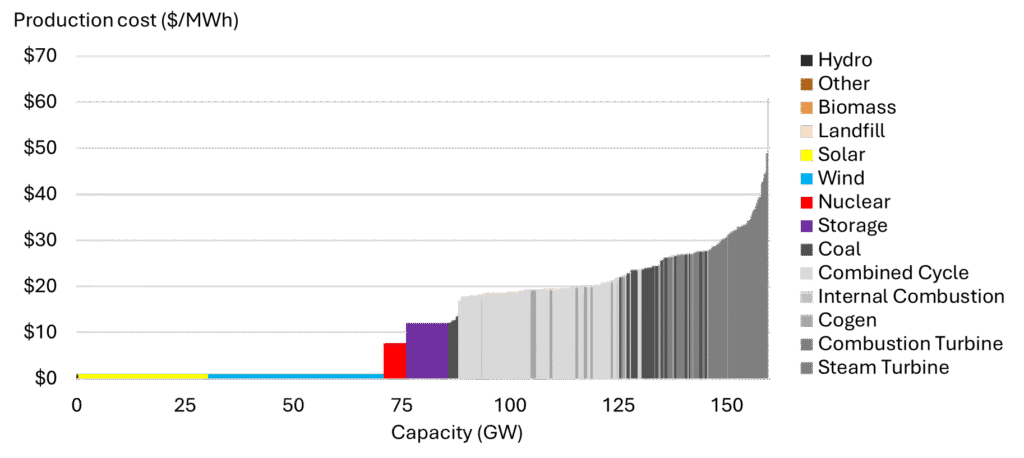

Renewable energy is the only way to affordably keep up with this surge in power demand. Safe harbor provisions have the potential to lock in the current tax credit rate for clean energy projects that come online over the next four years. This will delay more significant increases to power prices in the near-term, although there is plenty of upward pressure on prices unrelated to production costs. Even once the Investment Tax Credit expires, renewables remain the cheapest sources of power in much of the country on an unsubsidized basis (Figure 2). A customer can also lock in future prices which adds to the value proposition via reduced volatility of costs; whereas a gas-based contract will often pass the commodity price risk to the customer.

Figure 2: Estimated costs of unsubsidized generation resources, 2030 ($/MWh)

Immediately available power

Power supply and demand fluctuate throughout the day in any electricity system. Unlike fossil fuel generation, renewable energy projects like wind and solar have near-zero operating costs because they require no fuel. As a result, whether for technical or purely economic reasons, projects in some areas can generate more electricity than the grid can use. When this happens, local power prices drop to zero or even go negative, signaling to generators that they should stop producing. This is known as curtailment.

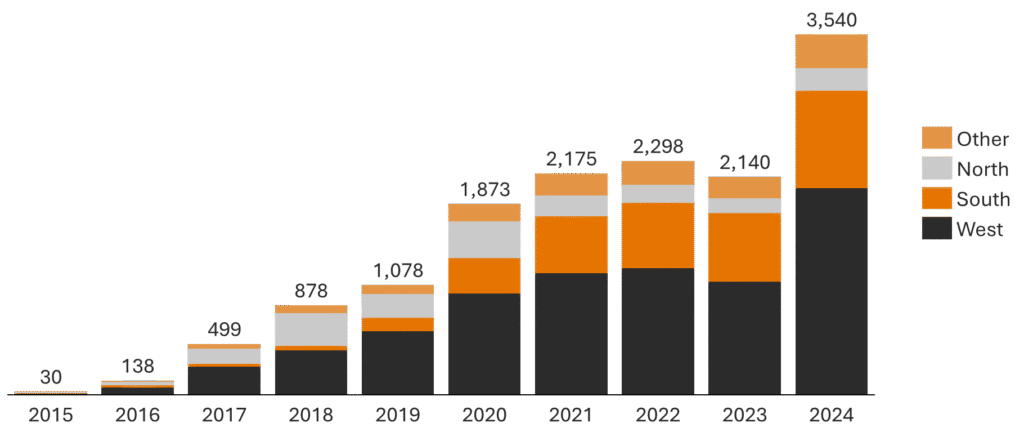

Frequent and costly curtailments are on the rise across the country, such as in ERCOT, the system that covers around 90% of Texas’ electric load (Figure 3). Placing new sources of demand, such as data centers, in these areas is an attractive solution here for both clean power assets owners and for customers. The asset owners increase their revenues from the sale of power, the renewable energy certificates (RECs) and the production tax credit (PTC) if applicable; the latter is able to buy power at even lower rates than shown in Figure 2.

Figure 3: Sum of negative power price hours across ERCOT (thousand hours)

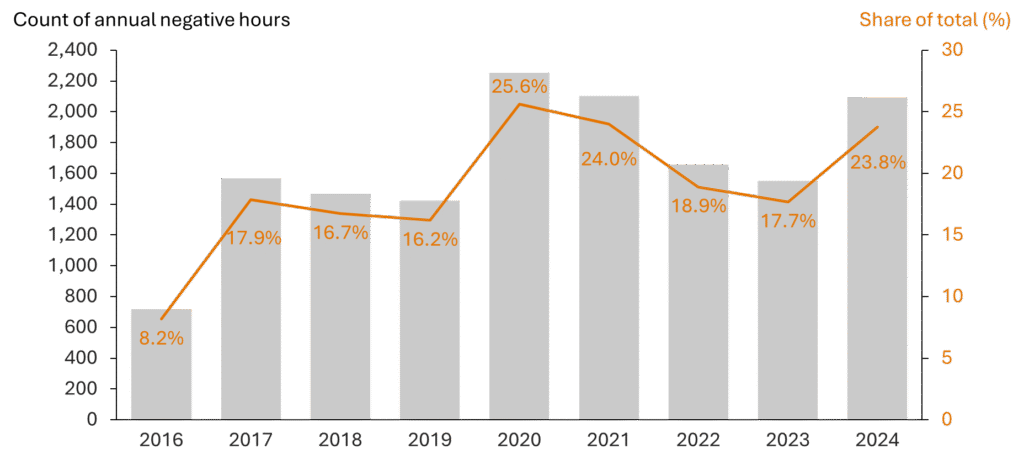

One company looking to make use of excess power is Soluna (SLNH). Soluna’s Project Dorothy is located next to the Briscoe Wind facility, where some 22% of hours over the last five years have had power prices below $0. As of end of 2024, Project Dorothy had consumed 112,942 MWh of energy that would have otherwise been curtailed since inception and the fully energized site is expected to consume 175,200 MWh per annum beginning in 2026.

Figure 4: Count and share of historical Briscoe Wind negative LMP hours (site of Project Dorothy)

Efficiency and Flexibility

In a race to secure scarce power, efficiency and flexibility are core competitive advantages. Soluna’s Project Dorothy for instance, has a Power Usage Effectiveness ratio of 1.03, well below the public cloud industry average of 1.25 and the on-premises enterprise data center average of 1.63 (AWS Cloud, International Data Corporation). The combination of the location of Project Dorothy and the flexibility delivered by Soluna’s MaestroOS software helps ensure access to clean, cheap power. The data center sources around 60% of its power from Briscoe Wind, with the remainder from the grid. It pays below market average prices for power from the wind project while providing a floor price for the wind asset owner, thus benefiting both parties. When power prices exceed $100/MWh, the data center ramps down, thus limiting its exposure to the higher prices. These prices also typically coincide with when the grid is dirtiest and so ramping down during these periods provides both cost and emissions benefits (Figure 5).

Figure 5: ERCOT merit order in 2024

Soluna’s MaestroOS software also ramps down the site in the event of an Emergency Response Service (ERS) signal. The ERS program is designed to maintain reliability during times of stress and by participating in the program, the data center asset provides grid stability. Project Dorothy joined the program in December 2023 and it generated $2.1 million in revenue in 2024 (SLNH 2024 Annual & Q4 Results & Business Update).

System benefits

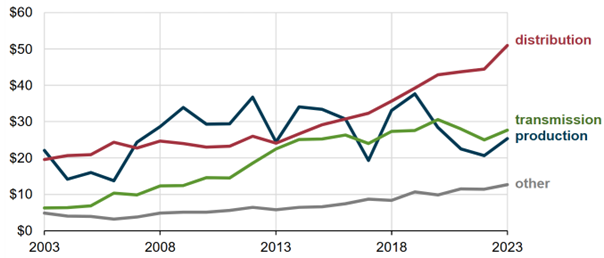

The grid is built to serve peak demand but is rarely operated at this level for any amount of time. Indeed, the average capacity utilization of the electric transmission network often clocks in at less than 40 percent of maximum capacity (Energize Capital). Transmission and distribution costs are also fixed, high, and rising. Utility spending to produce electricity fell 24% from 2003 to 2023, mainly due to lower fuel costs and, to a lesser extent, the retirement of older, costlier-to-maintain fossil fuel plants (EIA). Meanwhile, spending on electricity transmission systems nearly tripled over the same period while capital spending on distribution was the main driver of electricity spending increases over the last two decades (Figure 6). Adding more volume to the system without adding to the peak will spread the fixed costs of transmission and distribution over more kWh, making for a more affordable overall system.

Flexible demand can reduce peak load, increase the utilization of the existing network and bring down overall system costs. A 2025 study on Rethinking Load Growth found that “98 GW of new load could be integrated at an average annual load curtailment rate of 0.5%” (Duke University). I.e. Flexible demand could unlock nearly 100GW of new load in the US without waiting years and spending billions building out new transmission and distribution. In practice, data center demand flexibility is still in the early stages and will only be available at certain locations and for certain applications, for now. Soluna targets many of the more suitable applications in the near-term such as Bitcoin mining, machine learning, natural language processing and scientific computing. We expect AI data center owners and operators to continue to explore and invest in how to improve the flexibility of their own operations in order to unlock this potential (Axios, DCFlex).

Figure 6: Annual U.S. capacity additions by sector (2023 $ billion)

Contributors

Scott Gosselink

Managing Director, Credit

Logan Goldie-Scot

VP, Research and Impact

Ryan Miller

Principal, Private Credit

More insights

Industrial Decarbonization: How Thermal Storage Can Electrify Heat at Scale

Investment in thermal energy storage has accelerated in recent years as technical progress and customer demand have improved project bankability. Since 2020, sector funding has grown and shifted toward later-stage investors, reflecting greater confidence in TES’s readiness for commercial deployment.

Read moreConsolidation: The Pathway to Enduring Impact

It is easy to be disoriented by the swing from exuberance to pessimism that has defined the clean energy sector in recent years. Yet these moments are precisely when opportunity is greatest. Beneath the headlines are clear indicators of tremendous potential in the U.S. energy transition. The challenge is to separate fundamentals from sentiment, to acknowledge and fix the mistakes that we have made, and to chart a path to scale rooted in discipline, operational excellence, and commercial reality.

Read moreMeeting load growth with clean, flexible power

In the wake of the One Big Beautiful Bill, load growth remains a clear and steady tailwind for renewable energy. Renewables remain the cheapest source of power and the quickest to install, ensuring a bright outlook for the industry despite the shortened available window for some tax incentives. Over the last twenty years, annual investment in renewable energy in the U.S. increased from $5 billion to $100 billion (BloombergNEF, 1H 2025 Renewable Energy Investment Tracker). Compelling economics and flexible demand has the potential to unlock even greater investment in the sector: powering new load with electricity that would otherwise be wasted boosts project economics, ensures quick access to power, and delivers system-wide benefits.

Read more