DOWNLOAD

Submit the form below to continue your download

SUCCESS

Your download will begin shortly, if it does not start automatically, click the button below to download now.

DownloadBIO

Yasat Berk Manav is a Senior Associate on the investment team at Generate Capital. Berk has five years of experience, predominantly in sustainable infrastructure investing, and has executed over $650M of transactions.

Prior to Generate, Berk completed his graduate studies at Stanford University, where he was a graduate research assistant and his work on climate risk assessment for power infrastructure investments was published in the Renewable and Sustainable Energy Reviews journal. Prior to Stanford, he started his career on the Global Industrials Investment Banking team at Bank of America Securities in New York. Berk holds an M.S. in Civil and Environmental Engineering from Stanford University and a B.S. in Mechanical Engineering and Economics from Yale University, where he also completed the Energy Studies Multidisciplinary Academic Program.

Supporting the electrification of school buses

Across the US, school districts are choosing to electrify their school bus fleets. Electric school buses offer sizable health and environmental benefits, improving air quality and reducing noise pollution for students while cutting greenhouse gas emissions and serving as valuable grid resources.

Expert View By Berk Manav

BIO

Yasat Berk Manav is a Senior Associate on the investment team at Generate Capital. Berk has five years of experience, predominantly in sustainable infrastructure investing, and has executed over $650M of transactions.

Prior to Generate, Berk completed his graduate studies at Stanford University, where he was a graduate research assistant and his work on climate risk assessment for power infrastructure investments was published in the Renewable and Sustainable Energy Reviews journal. Prior to Stanford, he started his career on the Global Industrials Investment Banking team at Bank of America Securities in New York. Berk holds an M.S. in Civil and Environmental Engineering from Stanford University and a B.S. in Mechanical Engineering and Economics from Yale University, where he also completed the Energy Studies Multidisciplinary Academic Program.

Substantial federal grant funding, an increasing volume of policy mandates, and mounting pressure from parents, teachers, students, and communities for schools to decarbonize underpin the market.

Through the lens of an investor, school buses are prime candidates for electrification: bus routes are predictable and almost always fall within the range offered by EVs available today, most existing bus yards have ample space for charging infrastructure, unused energy from electric school buses can be monetized by being fed back to the grid which boosts overall grid reliability, and the funding available to help subsidize electric school buses is a result of a growing public demand for them.

Yet districts transitioning to electric buses face three persistent barriers to adoption: cost, complexity, and uncertainty. They must navigate sizable capital expenditures, technical and bureaucratic hurdles, and a bevy of market uncertainties that fall well outside their usual purview.

With the right strategy and partners, however, school systems can overcome these hurdles. Working with fleet electrification-as-a-service (FaaS) providers helps to simplify and accelerate the electrification process.

For example, the significant upfront capital required for electric school buses makes the purchase impossible for many resource-constrained public school districts. A partner providing FaaS can make the cost of electrification not only viable for school districts, but attractive, by converting capex to opex and helping the schools access grant funding.

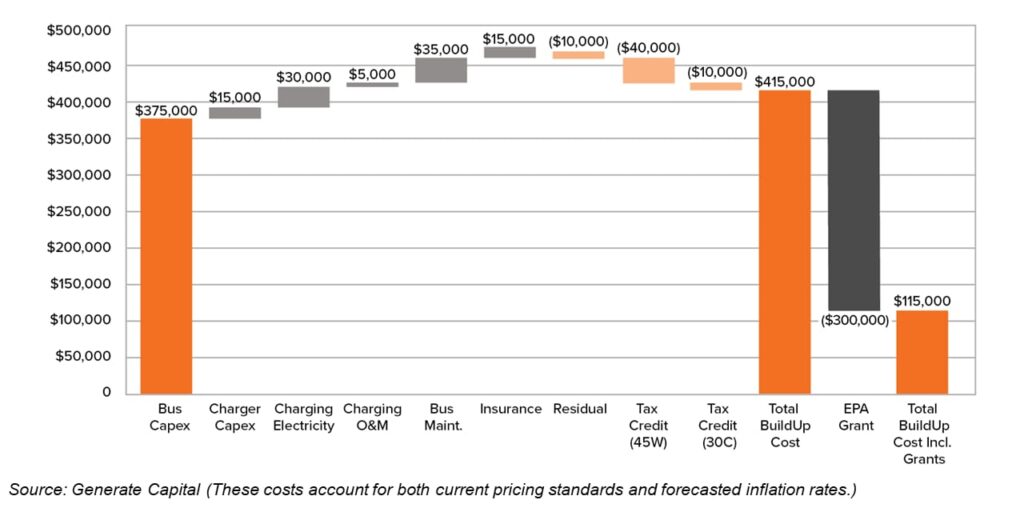

This support is key, as the availability of grant funding – particularly EPA funding – completely upends the cost comparison between electric school buses and their diesel counterparts today. At Generate we currently estimate the total lifetime cost of an electric school bus to be approximately $115,000. First, we sum all the associated costs, including capital expenditures of about $390,000 for the school bus and L2 charger. We then layer in school districts’ opportunities to access funding and reclaim value, through tax credits and the $300,000 in EPA grant funding.

By contrast, Generate estimates the current total cost of ownership (TCO) of diesel buses to be $345,000. These TCO models reveal that electric school buses can already serve as cheaper alternatives to diesel-powered fleets, though this hinges on a school district successfully accessing EPA grant funding. Looking ahead, while diesel bus costs are expected to remain steady, we expect the price of electric fleets to decrease sharply in the next several years. The current high volume of grant funding essentially serves as a near-term stopgap ahead of an impending, and enduring, market-based approach. The grants help the electric school bus industry scale, and scale in turn drives down costs.

By 2030, we forecast that capital expenditures for electric school buses will decrease and the likely price range of V2G benefits will account for a value similar to the existing 45W tax credit, making electric fleets cost competitive with diesel ones without government funding by the end of the decade.

Generate: Intelligence’s new whitepaper, “Accelerating Electrification of School Bus Fleets,” combines our team’s proprietary research and market analysis to explore the state of the school bus fleet electrification market, including its drivers, its impediments, and the FaaS model that can unlock its scale. Read the whitepaper here.

More insights

Industrial Decarbonization: How Thermal Storage Can Electrify Heat at Scale

Investment in thermal energy storage has accelerated in recent years as technical progress and customer demand have improved project bankability. Since 2020, sector funding has grown and shifted toward later-stage investors, reflecting greater confidence in TES’s readiness for commercial deployment.

Read moreConsolidation: The Pathway to Enduring Impact

It is easy to be disoriented by the swing from exuberance to pessimism that has defined the clean energy sector in recent years. Yet these moments are precisely when opportunity is greatest. Beneath the headlines are clear indicators of tremendous potential in the U.S. energy transition. The challenge is to separate fundamentals from sentiment, to acknowledge and fix the mistakes that we have made, and to chart a path to scale rooted in discipline, operational excellence, and commercial reality.

Read moreMeeting load growth with clean, flexible power

In the wake of the One Big Beautiful Bill, load growth remains a clear and steady tailwind for renewable energy. Renewables remain the cheapest source of power and the quickest to install, ensuring a bright outlook for the industry despite the shortened available window for some tax incentives. Over the last twenty years, annual investment in renewable energy in the U.S. increased from $5 billion to $100 billion (BloombergNEF, 1H 2025 Renewable Energy Investment Tracker). Compelling economics and flexible demand has the potential to unlock even greater investment in the sector: powering new load with electricity that would otherwise be wasted boosts project economics, ensures quick access to power, and delivers system-wide benefits.

Read more